Income Tax Form 16 is a certificate from your employer. It certifies that TDS has been deducted on your salary by the employer. If an employer deducts TDS on salary, he must issue income tax Form 16 as per tax rules of India. Form no 16 is issued once in a year, on or before 31st May of the next year immediately following the financial year in which tax is deducted.

One of the most important income tax form is Form 16. It contain most of the information you need to prepare your income tax return in India. Form 16 has two parts Part A and Part B.

Form 16 Part A has

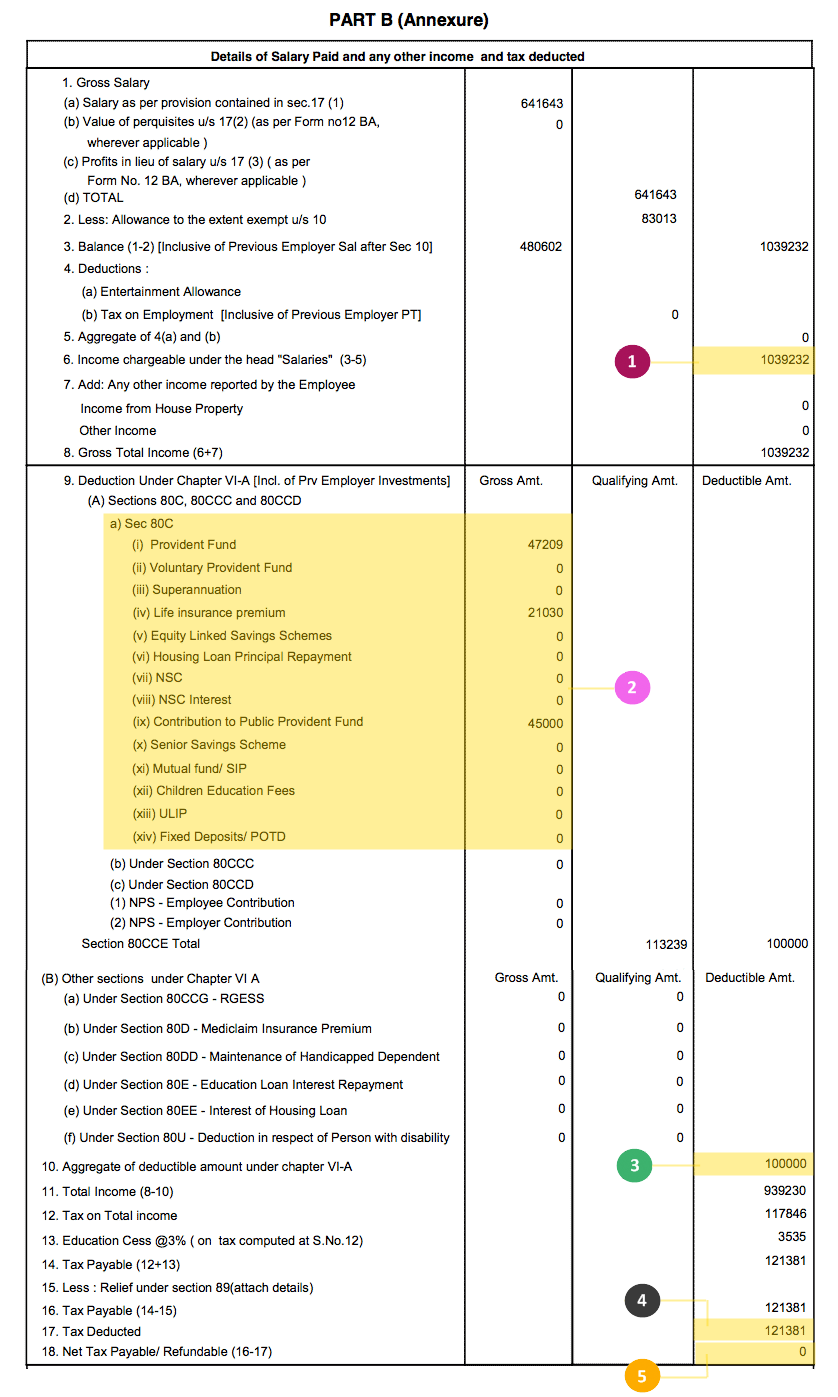

Form 16 Part B has

2 Breakup of Section 80C Deductions

2 TAN of Employer

4 Name and Address of Employer

6 Your (Taxpayer’s) Name and Address

Upload Form 16 and File Income Tax Return

Our software automatically picks up all the relevant information from your Form 16 and prepares your tax return. No need to enter anything manually.

Changed jobs during the year? Don’t worry if you have more than one Form 16. Upload them on MyAccountant and watch your income tax return get prepared automatically.

You can get your Form 16 from your employer. Even if you have left your job, your employer will provide you a Form 16. Unfortunately, this income tax form 16, cannot be downloaded from anywhere.

Though this is one of the most important income tax form, don’t worry if you do not have it. You can still file your income tax return. Click here to learn more.

TDS certificate in Form 16 is issued when TDS has been deducted. In case no TDS has been deducted by the employer, he may not give you a Form 16.

Any person responsible for paying salaries is required to deduct TDS before making payment. The Income Tax Act lays down that every person who deducts TDS from a payment, must furnish a certificate with details of TDS deducted & deposited. An employer in specific, is compulsorily required to furnish a certificate, in the format of Form 16.

In case an employer fails to provide you a Form 16 after deducting TDS; the minimum penalty that the employer will pay is Rs 100 for every day the default continues. You can write about this failure of your employer to the Assessing Officer who may take appropriate action against the employer, including levying penalty as mentioned above and also carrying out further proceedings against the employer.

Your Form 26AS, will have details of TDS deducted by your employer, you can check your TDS details from there – if the details don’t show up, well it means the employer deducted TDS from you and didn’t deposit with the government! In this case, you may have to pay tax to the government on your income yourself and later on claim from your employer.

While the onus of deducting tax on salaries and providing Form 16 is on the employer; the onus of paying income tax and filing income tax return is on you. If your income from all sources is above the minimum tax slab you are required to pay tax, whether or not your employer deducted TDS. Even when he fails to issue you a Form 16, you must file an income tax return.

WithMyAccountant, you can file your returns even if you don’t have a Form 16.

If you leave password fields empty one will be generated for you. Password must be at least eight characters long.